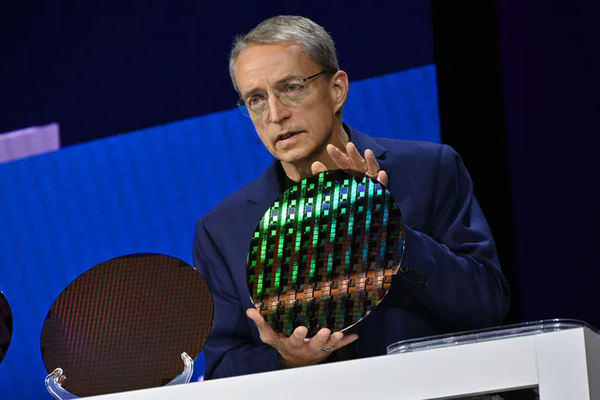

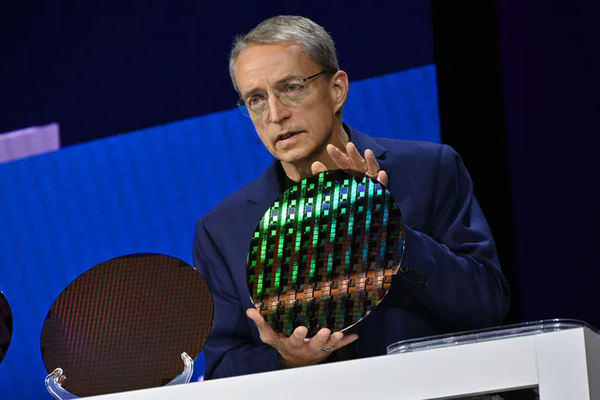

Intel is facing a financial crisis as CEO Pat Gelsinger unexpectedly resigned on Monday after less than four years in the role. While the official statement cited his retirement, sources from Reuters, Bloomberg, and The New York Times suggest that Gelsinger was pushed out by Intel’s board due to growing concerns over his leadership and ambitious turnaround plans. The company’s financial crisis has worsened as Gelsinger’s strategy failed to deliver results, and Intel’s market position continues to slip.

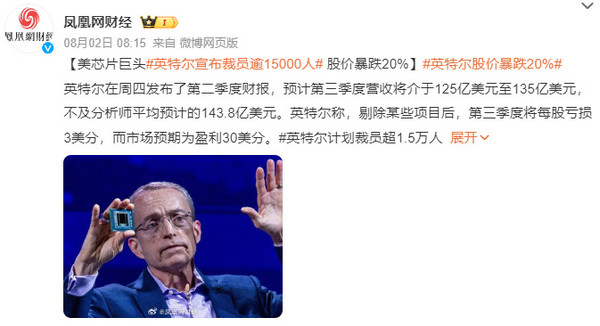

Pat Kissinger

Gelsinger’s Ambitious Plan for Intel: A Fading Dream

Pat Gelsinger took the helm of Intel in 2021 to turn the struggling chipmaker around within four years. His plan centered around embracing advanced technology, notably EUV (Extreme Ultraviolet) lithography, and bringing Intel back to the forefront of the chip industry. However, Intel’s costly and aggressive approach to catching up with rivals has failed to meet expectations, leaving the company in disarray.

Intel’s troubles date back years, from missed opportunities in the mobile market to quality control issues with its chips. The company’s failure to adapt to the smartphone revolution and the rise of artificial intelligence (AI) has compounded its decline.

Apple self-developed chips

Intel’s Struggles with Technology and Leadership

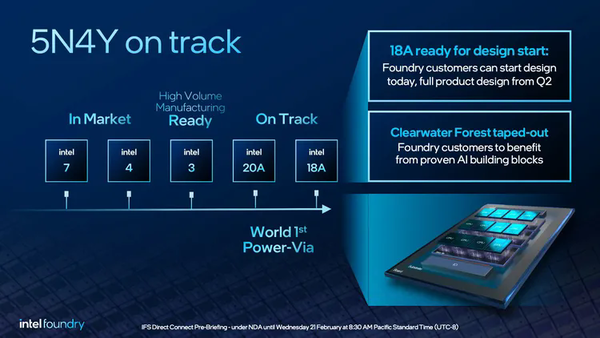

Before Gelsinger’s leadership, Intel faced a series of setbacks, including delays in chip production and quality issues that led Apple to switch to its own Arm-based chips. While Gelsinger was optimistic about Intel’s ability to recover, his ambitious promises—such as launching five generations of chips in just four years—have proven to be overly ambitious.

Intel’s Market Challenges and Missed Opportunities

Gelsinger’s biggest mistake, according to many industry experts, was Intel’s failure to secure cutting-edge technology by opting out of purchasing ASML’s EUV machines. TSMC’s decision to invest in these machines solidified its position as the dominant player in the chip-making industry, leaving Intel behind in the race for smaller, more efficient transistors.

In addition, Intel has struggled to capitalize on the AI boom. While rivals like Nvidia have surged to the forefront of AI chip development, Intel’s AI products, such as its Gaudi accelerator, have failed to meet expectations.

Four years and five nodes

Intel’s Financial Woes and Deteriorating Morale

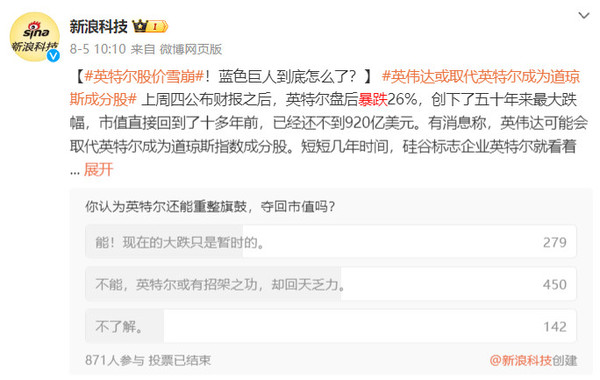

Intel’s financial crisis has worsened in recent years. Despite generating a profit of $2.7 billion in 2023, the company faced staggering losses in 2024, including a historic $16.6 billion loss in the third quarter, largely attributed to restructuring charges. This poor performance has led to widespread dissatisfaction among employees, with many citing layoffs and an uncertain future as factors driving them to leave the company.

Intel plans to lay off more than 15,000 employees

Board Discontent and Gelsinger’s Sudden Departure

Intel’s board, once optimistic about Gelsinger’s vision, has grown disillusioned with his leadership. According to sources, the board lost confidence in its ability to turn the company around quickly enough, particularly as Gelsinger’s ambitious transformation plan failed to deliver results. Concerns about product quality and the shift towards custom chip manufacturing further added to the board’s dissatisfaction.

Microsoft releases Copilot+PC

Intel’s Future in Peril: Will the Company Survive?

Intel faces a difficult path forward. The company’s attempts to pivot towards AI and graphics processing have not paid off, with rivals Nvidia and AMD gaining significant market share. Even Intel’s attempts to compete in the graphics space with its Lunar Lake laptop chips were met with financial losses, as the chips relied heavily on external partners, including TSMC.

Intel shares plummet 26%

The Possibility of Spinning Off Intel’s Foundries

In light of these challenges, some analysts suggest that Intel may eventually consider spinning off its foundry business, following in the footsteps of rival AMD. However, Intel’s $8 billion in funding from the U.S. government’s CHIPS Act complicates this potential move, as it restricts any significant changes to Intel’s structure.

Intel’s financial crisis has been exacerbated by poor leadership decisions and a failure to adapt to changing market demands, making it increasingly difficult for the company to regain its former glory.

Intel’s failure to meet ambitious promises and its struggles to catch up with competitors leave its future uncertain. With layoffs and financial losses mounting, it seems that Intel’s journey to recovery may be longer and more difficult than initially anticipated.

For further insights on technology and related topics, you can explore TinyDeals, a great resource for tech news and more.